Many businesses have suffered very much under covid. Not so, at least not so much, the US wine industry, according to the recently published State of the US Wine Industry 2022 report (which is, to a large extent, a look back on 2021). This is the twenty-first year that this fascinating report is published by Rob McMillan, Executive Vice President of the Silicon Valley Bank Wine Division (SVB).

Store sales increased and surpassed in some cases pre-pandemic levels, direct-to-consumer sales (DTC) were up, internet sales shot up. And it was a record year for mergers and acquisitions in the industry. And, perhaps most remarkable, one-third of the winery owners think 2021 is their best year ever. Ever!

While the sentiment of many wineries is evidently positive, it is, to some extent, hard to understand why.

Looking forward

Let’s first look at the predictions, what will the 2022 bring for the US wine industry?

Here are some of the key points:

- Sales are likely to decline, at least on a three-year horizon

- Lower prices ranges will face the most challenges, premium wine will be spare, for the moment

- The wine-consuming customer will get, on average, older – one of the major challenges for the industry, since younger people are less enthusiastic about wine

- Access to water will become more difficult and producers will have to think about solutions

- There will still be some over-supply

- Wineries that sell a big part of their production at the cellar door will have to rethink

Let’s then look at the analysis of what happened in 2021.

2021 Sales… flat

The SVB estimates that sales were essentially stable in 2021. They estimate the change in volume sales to be between -2% and 0% and counted in value between 0% and +2%. However, it isn’t easy to estimate since there have been so many movements between sales channels. 2020 was, of course, marked by radically restricted sales in restaurants and bars. Instead, many producers jumped on to the opportunity of developing online sales, which grew significantly. 2021 does not necessarily see a reversal of that.

The SVB had predicted at the beginning of the year that as covid restrictions started to ease, people would celebrate. And that this would lead to an increase in consumption. Well, people did celebrate, but they did not celebrate with wine. As the SVB puts it, “wine (…) wasn’t invited to the party”.

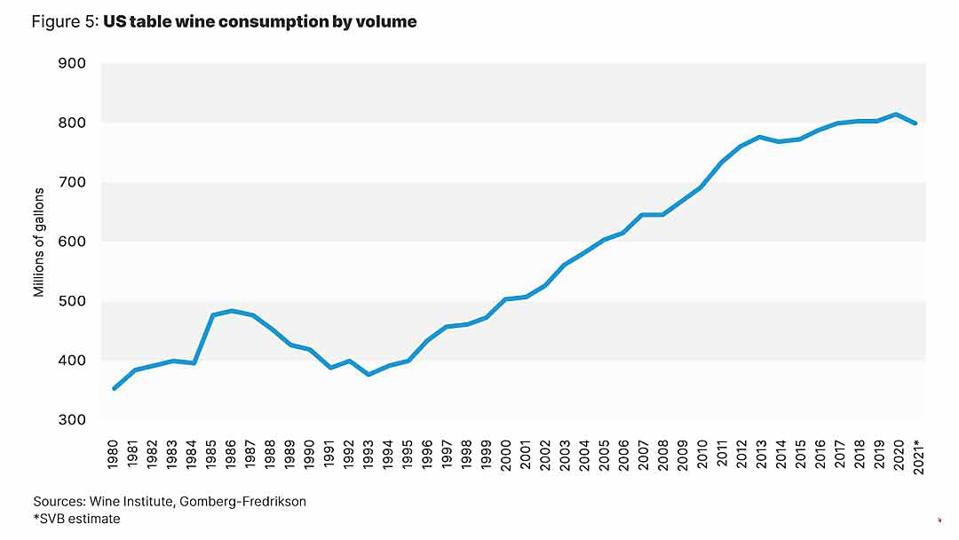

US Table Wine Consumption by Volume, graphic: Silicon Valley Bank

Silicon Valley Bank

Wine is not cool

One of the key messages in the analysis is that wine is losing market share to other alcoholic beverages and also to non-alcoholic beverages. Wine is not cool.

Wine has had a stable market share of total alcohol consumption in the US of around 18% since 2011. In 2020 it dropped almost one percentage point, from 18.1% market share to 17.3%, the biggest shift since before 2002. The winner is spirits, which have grown its market share from 29.1% in 2002 to 37.8% in 2020.

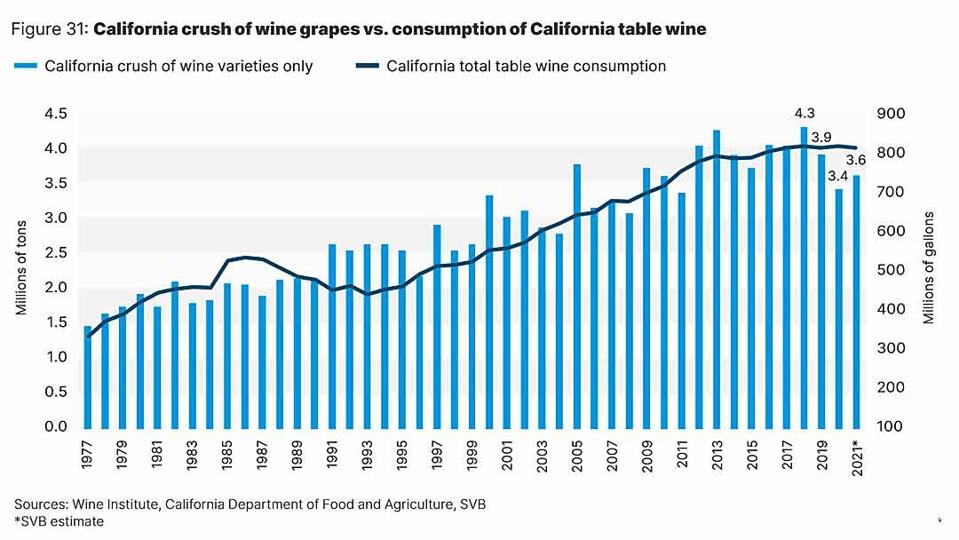

That is also reflected in the US table wine consumption. Between 1993 and 2013 it saw steady growth from around 400 million gallons at the start to almost 800 million gallons at the end. Since 2014 (a year of decline), the growth has been much slower, just edging up over 800 million gallons. The SVB estimates that consumption will again decline in 2021 and drop below 800 million gallons.

Wine is for the well-off and old(ish)

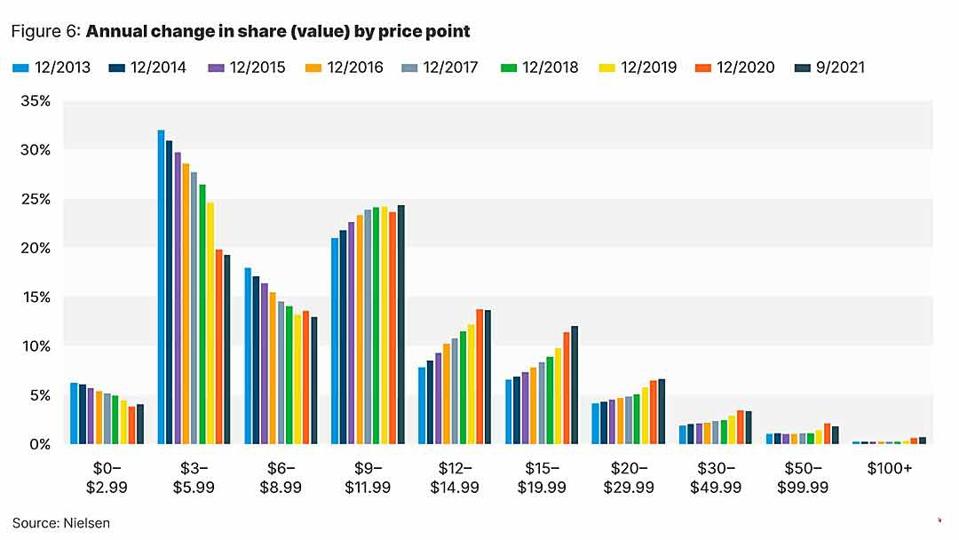

One not so gloomy part of this picture is that there has been a very clear shift to higher-priced wines. Wines for $8.99 and less has lost market share, from around 57% market share in 2013 to approximately 36% market share in 2021 (off-premise sales). The segment between $12 and $29.99 has gained the most.

Annual change in share (value), by price point, US wine sales, graphic: Silicon Valley Bank

Silicon Valley Bank

This is, of course, a good thing. But also a bad thing, because one of the reasons this shift is happening is that wine-drinkers are spending more dollars on the bottles because they are getting wealthier and older.

Wine is not attracting younger consumers as it used to.

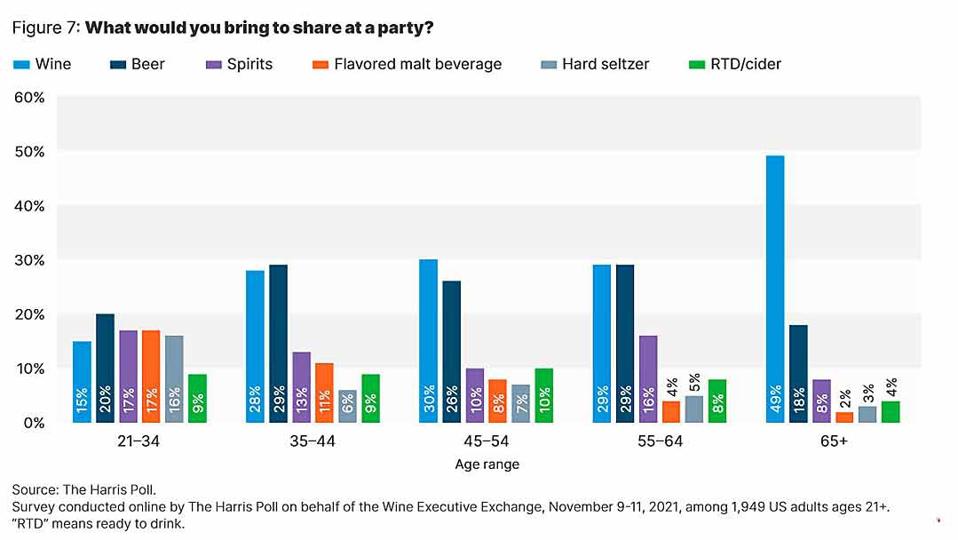

As an illustration of this, one the question “What would you bring to share at a party?” half over-65s (49%) answered wine. For the age bracket 21-34, only 15% said wine, with higher scores for beer, spirits, flavoured malt beverage, and hard seltzer. Looking at these numbers, one would not say that the future looks bright for wine as the young grow older. But to really understand if this is the case, one has to look at other factors. For example, has this always been the case, perhaps? That the young do not drink much wine, and as they grow older, they get a taste for it?

What alcoholic beverage would you bring to share at a party?, graphic: Silicon Valley Bank

Silicon Valley Bank

The roller-coaster of retail and restaurant sales

In many ways, it would make more sense to compare the situation in 2021 to 2019. The year in the middle, 2020, was thoroughly marked by the pandemic and stay-at-home recommendations, making for a problematic or skewed starting point for any comparison.

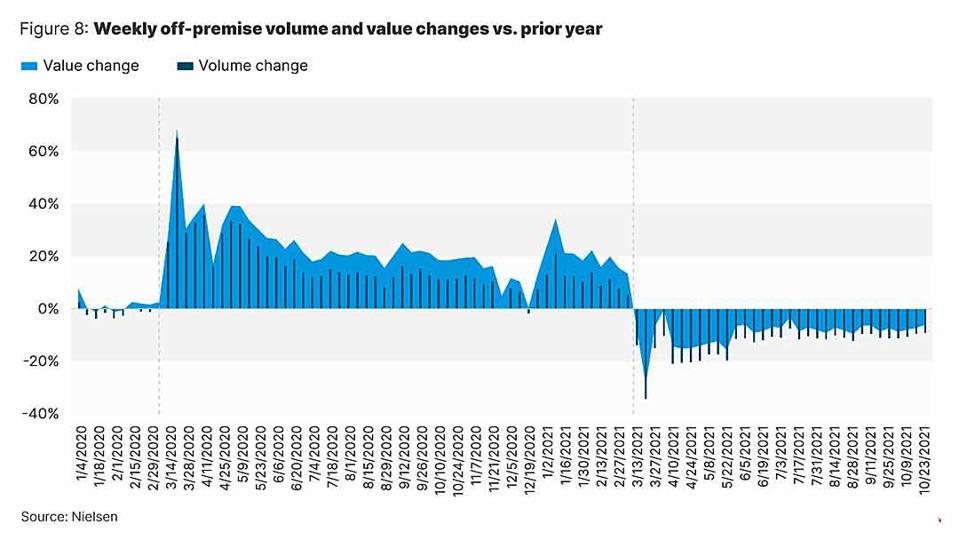

In 2020, retail sales (off-premise/off-licence) shot up compared to 2019. People did not go to restaurants. Instead, they consumed wine at home, maybe even stockpiled. Throughout the year, retail sales were doing very well. (A similar development was seen, e.g. on the Swedish monopoly market where the monopoly retail chain, Systembolaget, reported strong sales in 2020.)

Then came 2021, and the opposite happened. Retail sales dropped. But not as much as they had gone up in 2020.

Weekly off premise volume and value change to prior year, wine in the US, graphic: Silicon Valley … [+]

Silicon Valley Bank

The restaurant trade in wine shows, of course, the opposite pattern—a dramatic drop in 2020 and at least a partial recovery in 2021. But only partial; 2021 has still been a challenging year for restaurants and for wine sales in restaurants. The sector has also shrunk. The SVB notes that more than 10% of restaurants are thought to have closed due to the pandemic.

Another issue affecting wine sales in restaurants is the price evolution. Wine has become comparatively more expensive in restaurants and bars, driving consumers towards other drinks, mainly spirits. Wine is no longer the self-evident choice of drink to a meal. “Unless some solution is found, there is every reason to believe wine will continue to lose share to spirits and other beverages in the on-premise channel,” the SVB notes. More on the “solution” later.

Online sales doing very well indeed, thank you

Online sales boomed in 2020, with an increase of 32% compared to 2019. It reached almost 10% of total sales. Would 2021, with society slowly creeping back to “normal”, mean that internet wine sales fell to pre-pandemic levels?

It did not. The share of online sales as a percentage of total sales did shrink, but only a tiny bit, from 9.8% to 9.1%. Consumers continue to buy wine online. The SVB speculates that we may be seeing a permanent shift in buyer behaviour, with more wine purchased online. That seems to be a reasonably safe bet. We have seen a general shift to more online sales for a long time. There’s no reason to think that wine would be different.

The respondents to the SVB survey are also planning to increase their investments in the digital channel.

Times are great!?

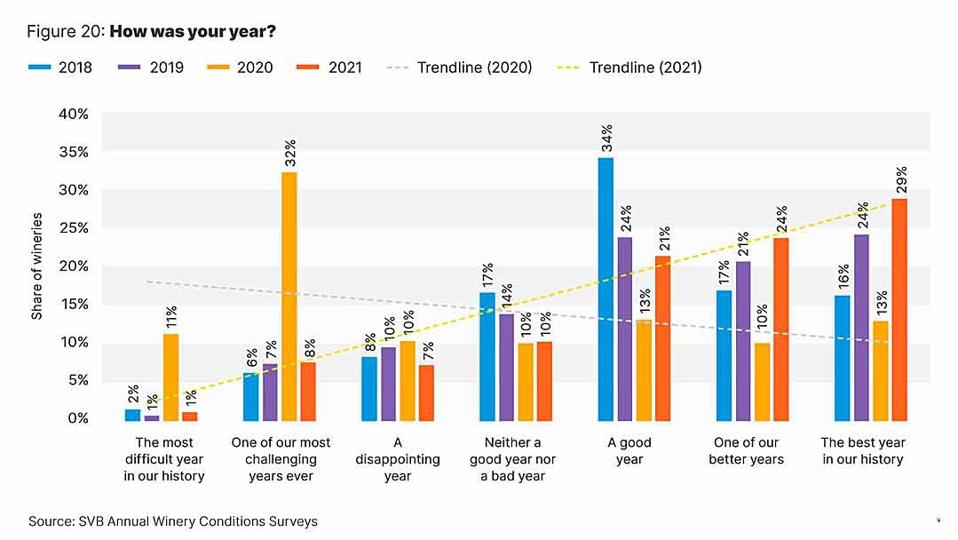

Perhaps the most remarkable finding in the SVB report is that wineries think times are good, and not only that, they say they’re doing great. A tidal shift from 2020.

In 2020, 41% of wineries who responded to the SVB poll said that it was one of the most challenging years ever, or even the most challenging.

In 2021, the picture was diametrically opposite: 53% say it is one of the better years or the best year in their history. 29% said it was the best year ever! The best year ever, not just better than the catastrophic 2020.

What has happened?

The SVB doesn’t really give any responses to the question. But they do present some interesting data from “premium wineries”. Their sales growth in 2020 was 21%, the best since 2007. Their average case price went up drastically from 2020, a year of discounting, to the best since at least 2015.

How was your year? US wineries reflect on 2021, graphic: Silicon Valley Bank

Silicon Valley Bank

The demographic alarm bells are ringing

The younger generations don’t see wine as the obvious choice to drink for dinners or parties, as mentioned before. The SVB considers this as a huge problem. Or rather, a HUGE PROBLEM.

“Unless the industry does more to attract consumers younger than 65, wine consumption might drop by 20 percent when boomers sunset.”

The USA is still the world’s biggest wine consumer, drinking 33 million hectolitres in 2020, according to the International Organisation of Vine and Wine, a year with zero growth. This follows a long period of good growth numbers. In 2000, the US consumed only just over 20 million hectolitres. In 2013, thanks to its rapid growth, it became the world’s biggest wine market, overtaking France.

Will the OIV figures for 2021, soon to be published, confirm a decline?

The bank points to one big issue: the wine industry is failing to attract the younger generations, failing in their marketing messages. The wine industry needs to come up with messages on issues like ethnic diversity, climate change and global warming, health and well-being, social justice, the environment and green issues and other themes that are important for the young people today, is their analysis.

Grape and wine over-supply

The US has seen two years of small harvests. But, despite that, grape and bulk wine prices have not gone up. The conclusion seems to be that stock levels are still satisfactory (or more), and the producers are not predicting an increase in demand (consumption).

Looking back, the harvest volumes have seen at least four decades of steady growth, from 1.5 million tons in 1977 to 4.3 million tons in 2018. The grape crush is now down 20% from that peak.

The SVB quotes Jeff Bitter, president of Allied Grape Growers, arguing for reducing the acreage planted with wine. Grub up vineyards. This seems to be a clear indication that there is currently an over-supply of grapes. However painful the recent wildfires on the West Coast were, they must somewhat have alleviated the over-supply.

Or perhaps consumers can look forward to a period of lower wine prices if the abundance of grapes continues?

California wine grape crush vs consumption of California table wine 1977-2021, graphic: Silicon … [+]

Silicon Valley Bank

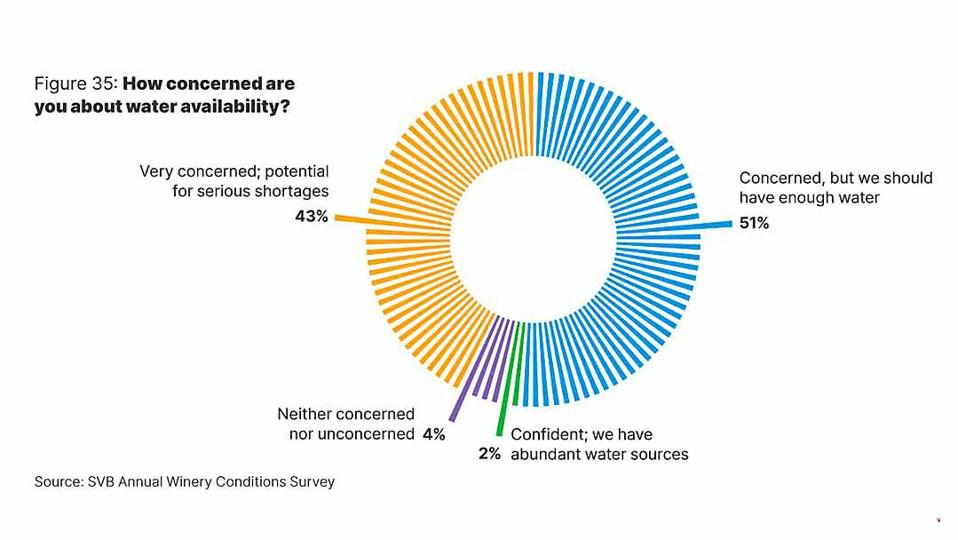

Turning water into wine

Another big challenge, especially in California, is access to water. California has suffered drought years, leading to some producers losing their water supply. But much of the water is piped from far away or even out-of-state. This is increasingly questioned, and supply is becoming less secure. 43% of growers are very concerned, predicting potential severe shortages.

This is yet another factor of the importance of sustainability and global warming that the SVB points to.

How concerned are you about water availability for your vineyards?, graphic: Silicon Valley Bank

Silicon Valley Bank

An on-ramp to revive the wine industry

It is a curious contradiction how the wineries see 2021 as a very good year, for many even the best ever, contrasted with the gloomy picture painted by the SVB. In particular, the bank is very worried about wine falling behind and being forgotten by younger consumers. The wine industry as a whole is not doing a good job of marketing to new consumers.

But instead of being just worried, Rob McMillan, the author of the SVB report, has decided to do something about it. Together with a few key colleagues in the US wine industry, he has launched a project to develop a new marketing program for the industry, addressing many of the issues that they see in the current situation. They hope to raise money from all over the wine industry for this research and promotion project, aptly named The WineRAMP, to get new customers onto the on-ramp to wine. I wish them luck and success.

You can download the report on the Silicon Valley Bank web site.

—Per Karlsson