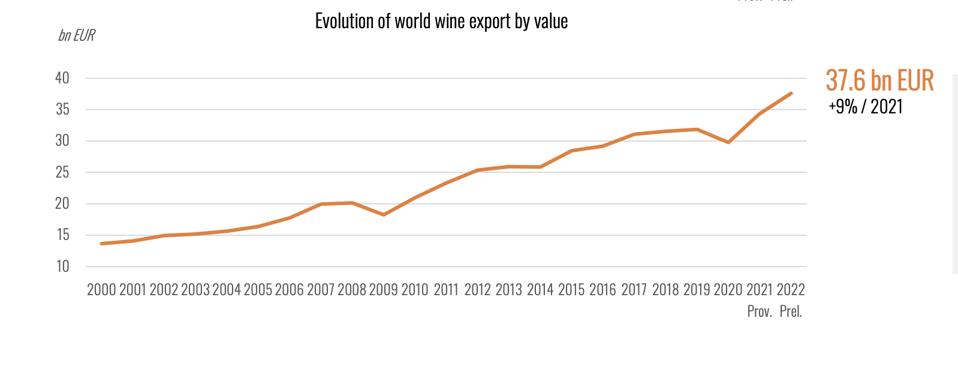

A combination of supply chain disruptions and inflation sent wine prices higher around the globe this year, resulting in a world record of €37.6 billion ($ 41.3 billion) of wine exports in 2022. This is a 9% increase over 2021.

“This breaks all records,” stated Pau Roca, Director General of the OIV (International Organization of Vine & Wine) in an online session recorded in Paris earlier today. “Even though volume was down slightly (-5%), value was up.”

The OIV, based in France, is the largest organization to collect global data on wine production, consumption, and trade. The statistics are shared with the public each Spring after all numbers have been tabulated.

Top Global Wine Exporting Countries in 2022

The top five wine exporting countries this past year by volume were: 1) Italy, 2) Spain, 3) France, 4) Chile, and 5) Australia. However the top value exporting country was France, up 12.3% over 2021. This could partially be due to the large increase in Champagne and sparkling wine sales, which outperformed still wine, with an impressive 18% increase in value in 2022, versus still wine at a 7% increase in value.

World Wine Export by Value from 2000 to 2022

U.S. Remains Largest Wine Consumer, While China Consumption Rates Decline

In 2022, the U.S. retained its top position as the number one largest wine consuming nation in the world, followed by France and Italy. Though predicted by some experts to eventually surpass France in wine consumption rates, Chinese wine consumption has continued to fall over the past several years. China now ranks #9 in world wine consumption by volume.

Jim Boyce, Chinese wine expert and author of the Grape Wall of China newsletter, provides some insights in his most recent article: “Following a disastrous 2021, when grape wine production fell 29% year-on-year to 268 million liters, the trade fell even further in 2022, dropping to 214 million liters, state official figures. That is less than a fifth of the 1.1 billion liters for 2016.”

In addition to lower than average grape harvests, other reasons for lower wine consumption in China are due to the fall out of Covid and much lower imports. Despite this, China’s own wine industry still seems to be thriving.

“Chinese wines have steadily grown in quality, have racked up contest medals and kudos from critics, and have attracted the attention of consumers, especially with the rise in interest in national goods,” reported Boyce in his newsletter.

Per Capita Wine Consumption Paints a Different Picture

Despite the U.S. and China’s dominance in the top 10 wine consuming countries, achieved in part due to their large populations, neither country ranks very high in per capita wine consumption. In this analysis, Portugal comes out on top at 67.5 liters per capita, followed by France, Italy, Switzerland and Austria – all smaller countries by population, but consuming more wine per person.

The U.S. only reaches the rank of #17 at 12.6 liters per capita, and China # 22 at .8 liters per capita. This is due to both countries having very large populations, but with fewer consumers who adopt wine as a preferred beverage. In the U.S., only about 42% of the population drinks wine, according to the Wine Market Council.

85 Wine Producing Countries in 2022

At the end of 2022, there were a total of 85 countries that produce wine globally. The top three largest wine producing countries are: 1) Italy, 2) France, and 3) Spain. Between these three countries, they produce more than 50% of the global wine production. The U.S. ranks 4th in global wine production, followed by Australia.

In 2022, total global wine production reached 258 million hectoliters, according to the OIV. This is a slight 1% decrease from 2021, and slightly below the 20 year average. Climate change, including extreme frosts, flooding, drought, and heat waves, is partially due to the lower production levels. In the end, Mother Nature is still in charge for the world of wine.

Pau Roca, Director General of the OIV in France Presenting on 2022 Global Wine Statistics